The Best Guide To Eb5 Immigrant Investor Program

Table of ContentsThe Eb5 Immigrant Investor Program DiariesThe Ultimate Guide To Eb5 Immigrant Investor ProgramEb5 Immigrant Investor Program Fundamentals ExplainedFacts About Eb5 Immigrant Investor Program UncoveredThe Eb5 Immigrant Investor Program StatementsWhat Does Eb5 Immigrant Investor Program Do?

This suggests that the new company (or its wholly possessed subsidiaries) should itself be the employer of the qualifying employees. For a brand-new commercial business located within a regional facility, the new business can straight or indirectly create the permanent positions. As much as 90% of the task production demand for local facility investors may be met utilizing indirect work.Indirect work are held outside of the brand-new company yet are created as an outcome of the brand-new business. EB5 Immigrant Investor Program. When it comes to a distressed business, the EB-5 capitalist may count on job maintenance. The financier must show that the number of existing employees is, or will be, no less than the pre-investment degree for a duration of at the very least 2 years

The loss for this period should be at least 20% of the distressed business' net well worth prior to the loss. When determining whether the troubled business has actually remained in existence for 2 years, USCIS will certainly think about followers in passion to the distressed company when reviewing whether they have actually been in presence for the exact same amount of time as the company they did well.

The Main Principles Of Eb5 Immigrant Investor Program

Jobs that are intermittent, temporary, seasonal, or short-term do not qualify as irreversible full-time jobs. Work that are anticipated to last at the very least two years are normally not considered periodic, momentary, seasonal, or transient. Funding implies money and all actual, personal, or blended substantial assets had and managed by the immigrant financier.

In a normal scenario, regional facilities manage compliance with the EB-5 program, while developers manage job administration and building. EB-5 capitalists, their partners, and youngsters can readjust their status within the United States, getting rid of the demand for consular processing and potential administrative processing hold-ups abroad. With simultaneous change filings, capitalists can make an application for job and copyright upon declaring.

The Buzz on Eb5 Immigrant Investor Program

As long as a youngster declare adjustment of condition before transforming 21, they will be shielded from maturing out under the Child Status Protection Act (CSPA). Even if visas subsequently come to be inaccessible while the primary financier's I-526E request is pending, USCIS will certainly process the youngster's change application once the concern date ends up being existing.

Elements include the kid's age when the moms and dad submitted the I-526E petition, the duration the application was pending, when a visa comes to be offered, and when the child availed themselves of the visa (EB5 Immigrant Investor Program). Capitalists abroad that have actually been rejected nonimmigrant visas as a result of viewed immigrant intent, who are incapable to find companies going to sponsor them for work visas, or that do not get family-based visas might still be qualified for long-term house via the EB-5 program

30, 2018, when it comes to Zhang v. USCIS, No. 15-cv-995, the United State Area Court for the District of Columbia certified a course that consists of any person who has a Kind I-526, Immigrant Request by Alien Investor, that was or will be rejected on the single basis of spending finance profits that were not secured by their own properties.

8 Easy Facts About Eb5 Immigrant Investor Program Described

In May 2019, we sent letters to all petitioners whose petitions we refuted and to petitioners who withdrew their I-526 requests. We intended to make certain to inform all potential class members. If you obtained this alert and do not believe that you are a potential course participant, please negligence the letter; you do not require to take any more action.

28, 2019, we appealed the court's choice. On Oct. 27, 2020, the U.S. Court of Appeals for the D.C. Circuit affirmed the area court's choice. With this choice, the court certified the course, and we are resuming and settling course member requests consistent with the court's decision. The info USCIS is asking for that you supply in your email to USCIS, and the associated evidence, is gathered under the Migration and Citizenship Act sections 103 and 203(b)( 5) and Title 8 of the Code of Federal Rules parts 103 and 204.6. The main purpose for giving the asked for info in your e-mail is to establish your eligibility as a course member and, if so, to make a determination whether to reassess your Type I-526 request.

10 Simple Techniques For Eb5 Immigrant Investor Program

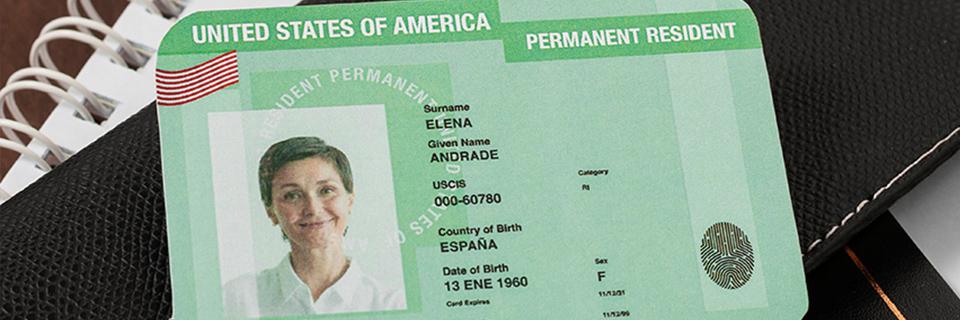

This Conditional residency will be legitimate for two years. Prior to the end of the two years the financier have to submit a 2nd petition with Migration to get rid of the conditions. In the request the financier have to show that the financial look here investment business is still readily active and has actually the required ten (10) workers.

As soon as a financier comes to be a Permanent homeowner the financier may offer or liquidate part or every one of the investment venture. Qualifying Investors Any type of individual, despite race may qualify for the EB-5 visa. Certifying financiers must, nevertheless, be actual individuals and not companies, although the financial investment should be made via a corporation.

Little Known Facts About Eb5 Immigrant Investor Program.

A capitalist can additionally produce a new enterprise by expanding an existing organization. To certify the growth must result in a rise of a minimum of 40 percent in the see here web worth of the business or in the number of employees of the business. Monitoring of the Business by the Investor An EB-5 applicant have to be involved in the monitoring of the new business.

The possessions of the financial investment venture upon which the petition is based may not used to safeguard any of the insolvency. Work Production To receive EB-5 standing, a financial investment normally should create full time employment for a minimum of 10 U.S. people, authorized long-term residents, or various other immigrants lawfully authorized to be utilized in the USA.

Households and individuals who look for to move to the United States on a permanent basis can request the EB-5 Immigrant Capitalist Program. The United States Citizenship and Migration Services (U.S.C.I.S.) established out various click requirements to acquire irreversible residency with the EB-5 visa program. The needs can be summarized as: The financier should fulfill capital expense quantity needs; it is normally required to make either a $800,000 or $1,050,000 capital expense quantity right into a UNITED STATE. When the possibility has been determined, the financier needs to make the financial investment and submit an I-526 application to the U.S. Citizenship and Immigration Solutions (USCIS). This request has to include proof of the financial investment, such as financial institution statements, acquisition arrangements, and service strategies. The USCIS will review the I-526 request and either accept it or request additional proof.